Can you spend the same amount of money every week?

The 1 Number Challenge gives you a single number to focus on, a max amount of money, that you can spend every week. Spend anything up to that amount for the week and you win, go over and you lose.

We’ll organize all of your expenses so that you can focus where it matters. Your personal spending. That’s the key to managing your money and knocking out every one of your money goals. We’ve identified three key habits you need to win the 1 Number Challenge every week.

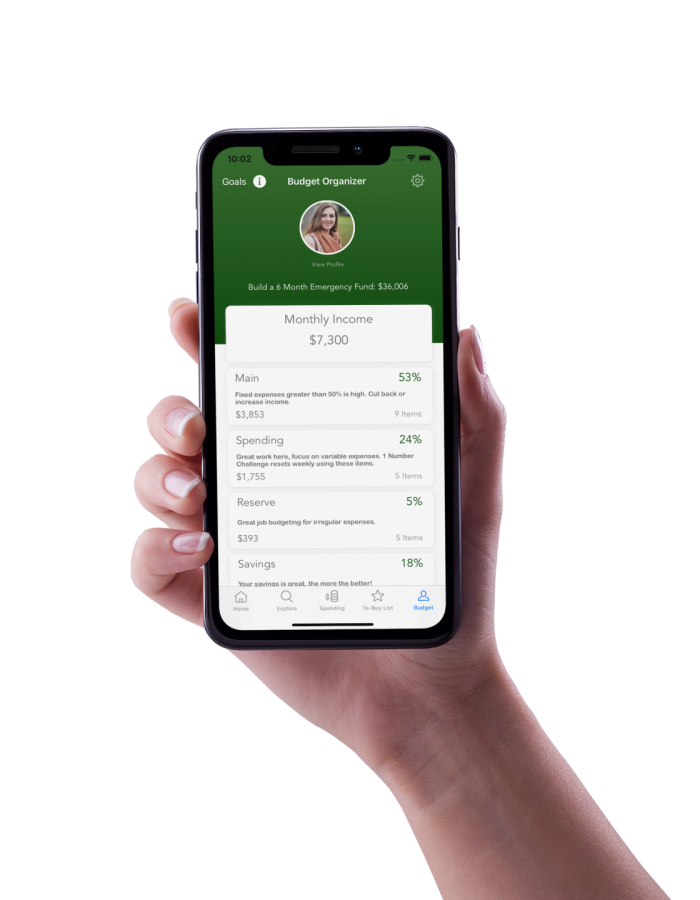

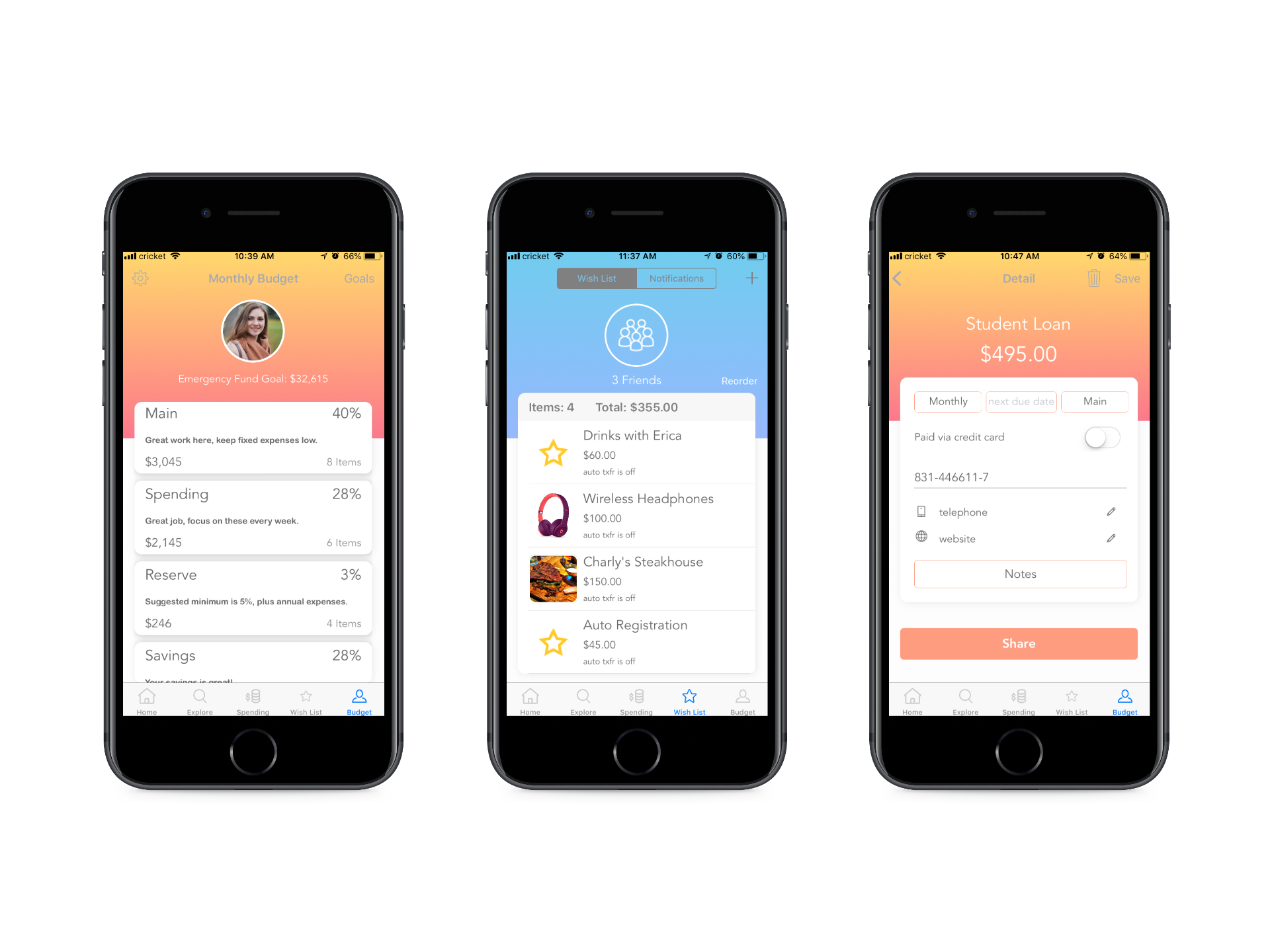

Know Your Numbers

Use the Budget Organizer to find your 1 Number after you organize income & expenses

Track Your Spending

The Spending Journal lets you track expenses to stay at or under your 1 Number

Plan ahead

The To-buy List fits upcoming expenses into your weekly spending perfectly, so you can win the 1 Number Challenge every week

When Tiniio resets every Friday we’ll ask how you did. How many weeks can you win?

Tiniio’s 1 Number Challenge isn’t about syncing accounts and balances. Winning with money is about sticking to your budget, and whether you’re any closer to your goals and dreams. All of which you’ll do every week when you win the 1 Number Challenge… the kinds of things you can’t download from your bank.

Spend Consciously With Tiniio

Control spending

Control spending Avoid debt

Avoid debt Achieve goals

Achieve goals Enjoy peace of mind

Enjoy peace of mind Engage friends

Engage friends Stay organized

Stay organized